|

Founded in

1842, as a joint stock bank, the Bank of Western India was reconstituted

in 1845, changing its name to the Oriental Bank and moving its head office

from Bombay to London. It was a move that appeared to cause some

consternation in Bombay, where, according to an article in The Times, the

shareholders were dissatisfied with the expense and conduct of their

London directors. However, it was an issue that appeared to fade, largely,

it would seem, not only because control resided in London rather than

Bombay, but also because there was much more available investment capital

in the former than the latter.

Of more importance, around this time was the Oriental Bank’s take-over, in

1849, of the Bank of Ceylon, which had been established in 1841,

incorporating the rights that went with joint stock banking in Ceylon.

More generally, it could be seen as part of a movement towards joint stock

banking in India, that both followed in the footsteps of joint stock

banking that began to emerge in England from around the middle of the

1820s, and that challenged the old agency houses in India.

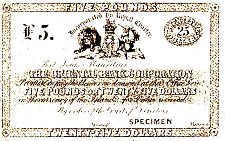

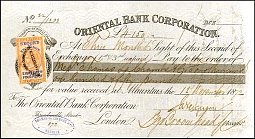

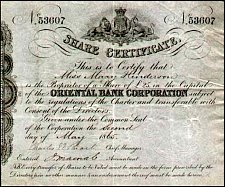

Eventually, in 1851, it was granted a royal charter that enabled it to

undertake international exchange banking in the trading region east of the

Cape of Good Hope. In response to this new status it changed its name, yet

again, to the Oriental Bank Corporation. As the first of the Eastern

Exchange Banks to centre its activities on India, it would provide a

reference point for the other exchange banks that followed. Over the next

twenty-two years, in the wake of what was a long economic boom, in which

the Indian economy grew at a fairly rapid rate, it managed to establish a

very successful exchange banking operation that linked India to Britain

and to other parts of the globe. In so doing, it survived what was a major

crisis in credit in the middle of the 1860s.

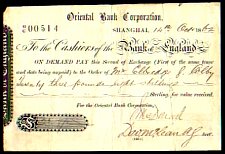

In 1873, however, when the global economy began to turn downwards, the

Oriental Bank Corporation began to encounter new conditions that were

emerging as a result of the transformation in the world economy, which was

manifested by a fall in prices, a decline in the growth rate of foreign

trade, and a changing and at times unstable system of international

currency, that was highlighted by a series of international conferences

that sought to address the question of bimetallism. As the world sank

deeper into recession, the inability of producers to realize the value of

their commodities on the world market, saw machines lie idle and

industrial capital stagnate.

Indeed, it was not until the 1890s – somewhere between 1893 and 1898

depending on the country – that the global economy began to move once more

into an upward swing. Ironically, however, the Oriental Bank Corporation

was unable to profit what would prove to be a rapidly growing economy.

Indeed, while it had succeeded in building a very sound banking operation

through until the 1870s, it began to struggle from around 1878, ceasing to

operate in 1884 and then revived as the New Oriental Banking Corporation

in the same year. With the growth of other banks such as the Hong Kong and

Shanghai and the Chartered Bank the new organisation was never succesful

and it finally closed its doors in 1892.

*

History courtesy of the AUSTRALIAN

NATIONAL UNIVERSITY via

Scripophily.com *

History courtesy of the AUSTRALIAN

NATIONAL UNIVERSITY via

Scripophily.com |

![]()